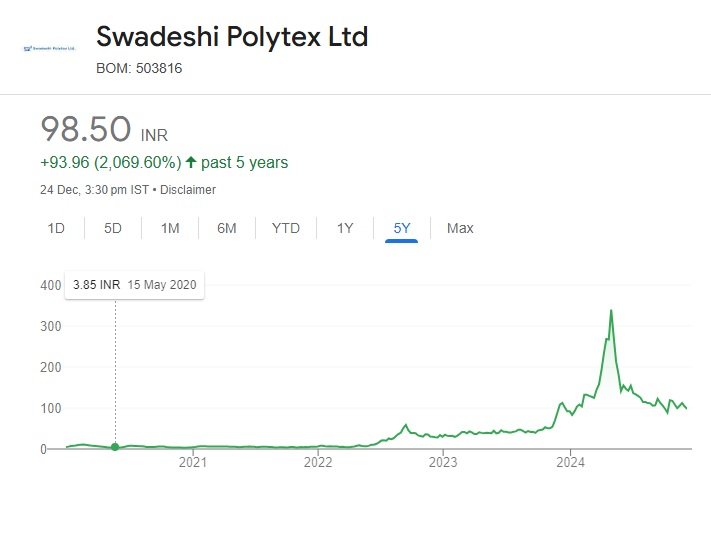

The Indian stock market has undergone major changes in recent years, and one area that continues to garner investor attention is the textile business. Swadeshi Polytex Ltd., a firm that manufactures synthetic and mixed yarns, is one of the leading competitors in this market. As with any stock, investors are constantly interested in a company’s future prospects and stock price targets. In this article, we’ll look at the potential Swadeshi Polytex Share Price Target 2025, taking into account the company’s finances, growth prospects, and current market conditions.

Company Overview

Swadeshi Polytex Ltd. is a well-known name in the Indian textile business. It specializes in the production of polyester, viscose, and nylon yarns, which are widely utilized in the textile and garment industries. With a strong manufacturing foundation, the company has managed to remain relevant in an increasingly competitive marketplace.

The company operates in many areas, including spinning, weaving, and dyeing, making it an important player in the Indian textile value chain. Swadeshi Polytex has made strategic investments throughout the years to modernize its facilities and diversify its product lines. This emphasis on expansion and innovation makes the company a promising stock to watch in the coming years.

Swadeshi Polytex Share Price Target 2025

Now that we’ve examined the elements driving the company’s performance, let’s have a look at potential price objectives for Swadeshi Polytex stock by 2025.

Current Price ₹ 98/-

| Year | Bullish Scenario | Intermediate Situation | Bearish Scenario |

|---|---|---|---|

| 2025 | ₹ 225 – ₹ 255 | ₹ 165 – ₹ 220 | ₹ 150 – ₹ 180 |

| 2030 | ₹ 950 – ₹ 1100 | ₹ 850 – ₹ 920 | ₹ 750 – ₹ 840 |

- Bullish Scenario : Swadeshi Polytex may achieve faster-than-expected growth if it effectively implements its development plans, cuts costs through technical upgrades, and capitalizes on rising textile demand in India and around the world. Under these conditions, the stock might reach a target price of INR 70 to 85 by 2025. This would be fueled by increasing profitability, increased market share, and a favorable business environment.

- Intermediate Situation : In a baseline scenario, if the company maintains a consistent growth trajectory alongside enhanced profitability, and the industry environment remains stable, the stock may experience moderate appreciation. Considering historical performance and prevailing market conditions, a plausible target could be approximately INR 50 to INR 60 per share by the year 2025. This projection indicates steady growth, provided the company does not encounter significant challenges.

- Bearish Scenario : In a pessimistic scenario, should global economic conditions deteriorate, raw material costs rise substantially, or if Swadeshi Polytex encounters operational challenges, the stock may experience stagnation or a potential decline. In such circumstances, the share price could remain in the range of INR 30 to INR 40 per share by the year 2025.

For further details, click here. Swadeshi Polytex

Company Essentials

- Market Cap : ₹ 384.15 Cr.

- Enterprise Value : ₹ 285.54 %

- No. of Shares : 3.90 Cr.

- P/E : 8.08

- P/B : 3.48

- Face Value : ₹ 1

- Div. Yield : 0 %

- Book Value (TTM) : ₹ 28.29

- Operating Revenue : ₹ 98.61 Cr.

- Debt : ₹ 0 Cr.

- Promoter Holding : 68.08 %

- EPS (TTM) : ₹ 12.19

- Sales Growth : 123.88

- ROE : 122.08 %

- ROCE : 146.60 %

- Profit Growth : 136.55%

Peer Comparison

| COMPANY | PRICERs. | MCAPCr. | P/B | P/E | EPSRs. | ROE% | ROCE% | P/S | EV/EBITDA |

|---|---|---|---|---|---|---|---|---|---|

| AGS Transact Tech | 66.50 | 845.29 | 1.46 | 0 | -1 | -12.83 | 0.28 | 0.81 | 6.38 |

| EKI Energy Services | 285.30 | 787.53 | 1.86 | 0 | -15.84 | -26.65 | -23.96 | 3.04 | -16.89 |

| PTL Enterprises | 41.51 | 550.03 | 0.90 | 18.34 | 2.27 | 4.95 | 11.86 | 8.55 | 8.62 |

| Majestic Auto | 433.25 | 450.47 | 0.74 | 28.22 | 15.35 | 4.68 | 10.38 | 9.34 | 10.03 |

| Infollion Research | 442.39 | 10.70 | 51.63 | 8.84 | 31.76 | 43.49 | 8.55 | 35.00 | |

| Swadeshi Polytex | 98.50 | 384.15 | 3.48 | 8.08 | 12.19 | 122.08 | 146.60 | 3.87 | 6.27 |

| Quint Digital | 79.06 | 372.75 | 2.39 | 0 | -1.31 | 5.10 | 7.42 | 11.22 | 21.16 |

| Trishakti Industries | 187.40 | 306.04 | 12.17 | 162.52 | 1.15 | 4.79 | 7.68 | 2.86 | 89.04 |

| Silicon Rental Solut | 271 | 278.37 | 4.43 | 21.58 | 12.56 | 22.68 | 29.28 | 4.40 | 7.09 |

| Crown Lifters | 270.99 | 3.73 | 16.56 | 13.53 | 19.26 | 18.38 | 9.64 | 14.36 |

Quarterly Result (All Figures in Cr.)

| PARTICULARS | Sep 2023 | Dec 2023 | Mar 2024 | Jun 2024 | Sep 2024 |

|---|---|---|---|---|---|

| Net Sales | 40.17 | 54.55 | 0 | 0 | 0 |

| Total Expenditure | 1.81 | 2.68 | 1.69 | 0.63 | 0.70 |

| Operating Profit | 38.36 | 51.87 | -1.69 | -0.63 | -0.70 |

| Other Income | 1.82 | 1.85 | 1.79 | 1.87 | 1.87 |

| Interest | 0 | 0 | 0 | 0 | 0 |

| Depreciation | 0.01 | 0.01 | 0.04 | 0.04 | 0.04 |

| Exceptional Items | 0 | 0 | 0 | 0 | 0 |

| Profit Before Tax | 40.18 | 53.72 | 0.06 | 1.20 | 1.13 |

| Tax | 7.59 | 7.97 | -0.18 | 0.39 | 0.39 |

| Profit After Tax | 32.59 | 45.75 | 0.24 | 0.81 | 0.74 |

| Adjusted EPS (Rs) | 8.36 | 11.73 | 0.06 | 0.21 | 0.19 |

Profit & Loss (All Figures in Cr. Adjusted EPS in Rs.)

| PARTICULARS | Mar 2020 | Mar 2021 | Mar 2022 | Mar 2023 | Mar 2024 |

|---|---|---|---|---|---|

| Net Sales | 15.99 | 0 | 36.23 | 44.34 | 99.26 |

| Total Expenditure | 3.64 | 2.14 | 2.88 | 3.55 | 6.82 |

| Operating Profit | 12.35 | -2.14 | 33.35 | 40.79 | 92.44 |

| Other Income | 2.67 | 0.16 | 0.47 | 2.47 | 6.67 |

| Interest | 0.70 | 0 | 0 | 0 | 0 |

| Depreciation | 0.01 | 0.01 | 0.01 | 0.02 | 0.05 |

| Exceptional Items | 0 | 0 | 0 | 0 | 0 |

| Profit Before Tax | 14.30 | -1.99 | 33.81 | 43.24 | 99.06 |

| Tax | 2.46 | -0.37 | 8.35 | 8.37 | 16.57 |

| Net Profit | 11.85 | -1.64 | 25.53 | 34.85 | 82.35 |

| Adjusted EPS (Rs.) | 3.04 | -0.42 | 6.53 | 8.94 | 21.15 |

Balance Sheet (All Figures are in Crores.)

| Particulars | Mar 2020 | Mar 2021 | Mar 2022 | Mar 2023 | Mar 2024 |

|---|---|---|---|---|---|

| Equity and Liabilities | |||||

| Share Capital | 3.90 | 3.90 | 3.90 | 3.90 | 3.90 |

| Total Reserves | -36.24 | -37.88 | -12.35 | 22.49 | 104.85 |

| Borrowings | 0 | 0 | 0 | 0 | 0 |

| Other N/C liabilities | -2.20 | -2.56 | 1.16 | 2.17 | 2.17 |

| Current liabilities | 47.24 | 46.60 | 40.26 | 36.53 | 1.31 |

| Total Liabilities | 12.70 | 10.06 | 32.97 | 65.10 | 112.23 |

| Assets | |||||

| Net Block | 0.09 | 0.07 | 0.07 | 0.08 | 4.97 |

| Capital WIP | 0 | 0 | 0 | 0 | 0 |

| Intangible WIP | 0 | 0 | 0 | 0 | 0 |

| Investments | 0 | 0 | 0 | 0 | 0 |

| Loans & Advances | 3 | 0.59 | 0.42 | 0.38 | 0.01 |

| Other N/C Assets | 0 | 0 | 0 | 11.80 | 6.19 |

| Current Assets | 9.62 | 9.39 | 32.48 | 52.84 | 101.06 |

| Total Assets | 12.70 | 10.06 | 32.97 | 65.10 | 112.23 |

Cash Flows (All Figures are in Crores.)

| PARTICULARS | Mar 2020 | Mar 2021 | Mar 2022 | Mar 2023 | Mar 2024 | |||

|---|---|---|---|---|---|---|---|---|

| Profit from operations | 14.30 | -2.01 | 33.90 | 43.20 | 98.87 | |||

| Adjustment | 0.49 | -0.11 | -0.46 | -2.45 | -6.62 | |||

| Changes in Assets & Liabilities | 4.95 | -0.07 | -3 | -1.77 | -31.86 | |||

| Tax Paid | -2.50 | 0 | -4.66 | -7.34 | -16.52 | |||

| Operating Cash Flow | 17.24 | -2.18 | 25.79 | 31.65 | 43.87 | |||

| Investing Cash Flow | 0.16 | 0.13 | -22.17 | -34.41 | -43.81 | |||

| Financing Cash Flow | -15.67 | 0 | -1.79 | 0 | 0 | |||

| Net Cash Flow | 1.73 | -2.05 | 1.83 | -2.76 | 0.06 |

Shareholding Pattern

| Summary | Sep 2024 | Jun 2024 | Mar 2024 | Dec 2023 | Sep 2023 | Jun 2023 | Mar 2023 | Dec 2022 | Sep 2022 | Jun 2022 | Mar 2022 | Dec 2021 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Promoter | 68.1% | 68.1% | 68.1% | 68.1% | 68.1% | 66.4% | 63.2% | 63.2% | 63.2% | 63.2% | 63.2% | 63.2% |

| FII | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% |

| DII | 0.1% | 0.1% | 0.1% | 0.1% | 0.1% | 0.1% | 0.1% | 0.1% | 0.1% | 0.1% | 0.1% | 0.1% |

| Public | 31.8% | 31.8% | 31.8% | 31.8% | 31.8% | 33.5% | 36.7% | 36.7% | 36.7% | 36.7% | 36.7% | 36.7% |

“The financial figures mentioned in this analysis are derived from Ticker by Finology for accuracy and reliability.”

Key Factors Influencing Swadeshi Polytex’s Stock Price

To effectively analyze the share price target, it is essential to first examine the critical factors that may influence Swadeshi Polytex’s stock price in the medium term, extending to 2025.

Industry Growth Prospects

The textile sector in India ranks among the largest globally and is crucial to the nation’s economic framework. With governmental initiatives such as Atmanirbhar Bharat and Make in India gaining momentum, there exists substantial potential for expansion within this industry. The rising demand for synthetic and blended fibers, along with the burgeoning domestic apparel market, presents favorable prospects for textile producers, including Swadeshi Polytex.

The Indian textile industry is increasingly embracing modern technologies, including automation, artificial intelligence, and the Internet of Things, which are contributing to improved productivity and cost reduction. By aligning with these industry trends, Swadeshi Polytex is positioned to gain from increased efficiency and enhanced competitiveness in the market.

Financial Performance and Profitability

To assess the potential of Swadeshi Polytex’s stock, it’s important to look at its financial health. Historically, the company has shown a stable revenue growth trajectory, although its profitability has been impacted by fluctuations in raw material prices and demand cycles. The textile industry is highly dependent on global commodity prices (like crude oil, which impacts synthetic yarn prices), and any price changes could affect margins.

The capacity of the company to control expenses, uphold a robust profit margin, and produce substantial cash flows will be essential for its enduring viability. Investors ought to monitor the quarterly earnings attentively, with particular emphasis on profit growth, debt ratios, and strategies for expansion.

Technological Upgrades and Expansion Plans

Swadeshi Polytex’s commitment to modern technology and its strategic expansion initiatives are expected to be crucial for its future development. As the textile industry increasingly adopts environmentally friendly methods, sustainable production techniques, and advanced spinning and weaving technologies, Swadeshi Polytex’s emphasis on these aspects may set it apart from its rivals.

Announcements regarding the company’s expansion of production capacity, entry into new markets, or the introduction of innovative products may have a favorable effect on its stock price.

Global Economic Conditions

Swadeshi Polytex is influenced by both domestic economic factors and international trends. As a participant in the textile export sector, fluctuations in global demand or disruptions in the supply chain can significantly affect the company’s performance. Additionally, trade agreements, variations in global commodity prices, and economic conditions in key textile markets like the United States and Europe can all have an impact on the stock price.

Government Policies and Regulations

Government policies concerning the textile sector, including export incentives, subsidies, and modifications in tax rates, can profoundly influence the financial performance of Swadeshi Polytex. Additionally, the government’s emphasis on sustainable and environmentally friendly manufacturing methods may benefit companies that are proactive in implementing these practices.

Conclusion

The share price target for Swadeshi Polytex in 2025 is influenced by various factors, such as market dynamics, governmental regulations, and the company’s capacity to implement its expansion strategies. Considering the favorable projections for the Indian textile sector and the company’s strategic investments in technology, Swadeshi Polytex is likely to witness substantial growth in the years ahead.

It is crucial to acknowledge that, like any investment, there are inherent risks that must be taken into account. Investors should monitor the company’s quarterly performance as well as any changes in the broader economic landscape. Conducting comprehensive research, assessing one’s own risk tolerance, and seeking guidance from financial advisors are advisable steps prior to making any investment choices.

Considering these factors, investors can more effectively assess the potential of Swadeshi Polytex Ltd. as a stock to monitor in the future.

Read more: Swadeshi Polytex Share Price Target 2025